Offshore Property

Investing in offshore property is not reserved for only the wealthy

Financial savvy South Africans that can’t / won’t immigrate have one mission—acquiring offshore property/investments… in a hurry. Many South Africans, however, still mistakenly believe that offshore property is either not an option or is a privilege reserved for only the wealthy.

Economic and Political decline in SA

South Africa has seen several years of economic and political decline. The uncertainty is undoubtedly growing. Most South Africans feel pressured to have a Plan B – an offshore investment or asset that increases in value and/or earns an income outside of SA in Dollars.

Rand's Declining Value

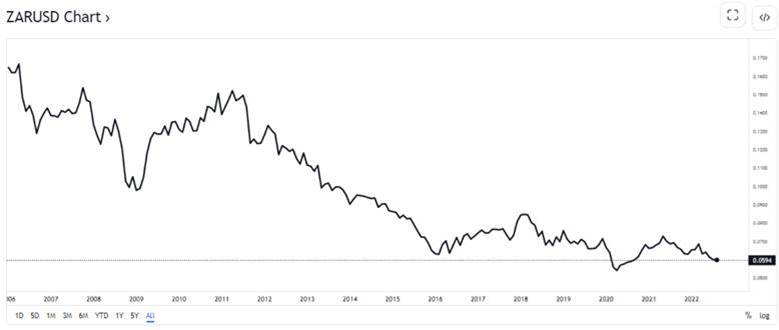

Over the last few years, the rand has depreciated significantly, and it’s generally expected to keep devaluating against all major currencies.

The rand is at the mercy of the political landscape, protests, load shedding… you name it.

“For the past decade, the major trend in the South African investment space has been the growing number of local investors looking to offshore investments to hedge their earnings against a volatile rand”, says Coreen van der Merwe, director of Sovereign Trust SA Limited.

Reference: https://www.tradingview.com/symbols/ZARUSD/

Increasing unemployment and social unrest

SA is officially marked as the country with the highest unemployment rate in the world.

Growing uncertainty about our future

Building wealth in SA is becoming increasingly difficult. South Africa’s economic and social decline is so severe that there has been a spike in emigration and offshore investment. People strongly desire a firm Plan B, such as residency in another country or through significant property investment.

Low or no capital growth

Most South Africans believe that investing in real estate (rental property) is the best way to provide for our families and retirement years. However, rental property investment these days have significant challenges. Unique factors in South Africa directly impact a landlord’s ability to generate positive cash flow. Supply and demand, escalating crime, increasing unemployment, rising debt levels, and non-payment of rent, to name a few.

These days many investors are attracted to the low maintenance of ‘buy to let’ self-storage properties. No more early-morning calls regarding a burst geyser, spending hours on property management, or dealing with damage to the property.

What exactly is ‘Buy to let’ self-storage?

- “The renting of self-storage facilities on a short-term basis to individuals (usually household goods) or businesses (excess inventory or archived records)

- The tenant has exclusive access to the storage space and usually rents on a month-to-month basis”

- Investing in self-storage is a low-maintenance way to earn returns on investment.

- These days many investors are attracted to the low maintenance of ‘buy to let’ self-storage properties. No more early-morning calls regarding a burst geyser, spending hours on property management, or dealing with damage to the property.

Top 7 Reasons to Invest in Self-Storage Right Now

Lower capital barrier to entry

The cost of investing in a residential property for rental purposes (‘buy to let’) is much higher than a self-storage unit. The building cost of a self-storage unit is substantially lower, making investing in these units much more accessible to everyone, i.e. less expensive to purchase and less capital input. With self-storage units, the ongoing expenses are much lower than with residential properties, as the frequency of use is less and high-cost areas such as kitchens and bathrooms do not exist.

Low maintenance costs

The primary purpose of owning a rental property is to generate a passive income. Ongoing monthly expenses diminish profits, as costs such as maintenance and repairs, security, garden services, levies, insurance, insurance excesses and rates can be hefty compared to the rental income.

Self-storage units don’t need substantial maintenance or management as per residential properties. Units are kept clean and functional without needing high-end fittings, décor, running water, electricity, or other finishes.

Liquidity

The liquidity on self-storage units will be better than residential properties, purely as the entry price is much lower, providing a bigger buyers’ market.

Tenant vacancies

Tenant vacancy can put a landlord under financial pressure. Investors outsmart this risk with multiple self-storage units – if one unit is vacant, the others can still generate a rental income. In comparison, a vacant big-ticket residential property can leave a big hole in a landlord’s pocket. Keep in mind that investors can buy nearly 15 units for the price of one residential property.

No disruptive/difficult tenants

Many landlords find managing tenants extremely tedious, complex and downright difficult.

With ‘buy to let’ self-storage units, the investor outsources the management of his/her units. Management includes marketing, advertising, tenant relationships, maintenance and all other legal obligations. This is a truly passive investment.

High demand

One in ten US households rent a self-storage unit, with growing demand.

Self-storage is reported as one of the most resilient asset classes to invest in, as the number of people using storage continues to rise.

Recession-proof

There is a belief amongst investors that the self-storage industry is recession-proof. This is based on the 5.1% total return to investors during the 2008 Great Recession in the US. Similar figures were reported during the Covid-19 pandemic, proving self-storage is always in demand.

Just how big is the self-storage industry?

A few decades ago, the concept of self-storage was relatively unknown. Today it is a multi-billion dollar industry worldwide.

South Africa:

South Africa has seen massive growth in the self-storage industry and is estimated to be worth hundreds of millions of rand.

You will easily find them all over every major city. Privately owned storage units are offered even in our smaller towns.

United States:

The US is the birthplace of self-storage in the 1960s. The industry has grown today to an estimated 50,000 facilities countrywide and growing.

Today the self-storage industry in the US is worth $22 billion and is also growing exponentially in Europe.

US Self Storage Industry Statistics: Click here

UK:

The Self-storage industry got started much later – London 1980’s

The annual industry turnover:

In 2016 – £540 million

In 2022 – £930 million

Europe:

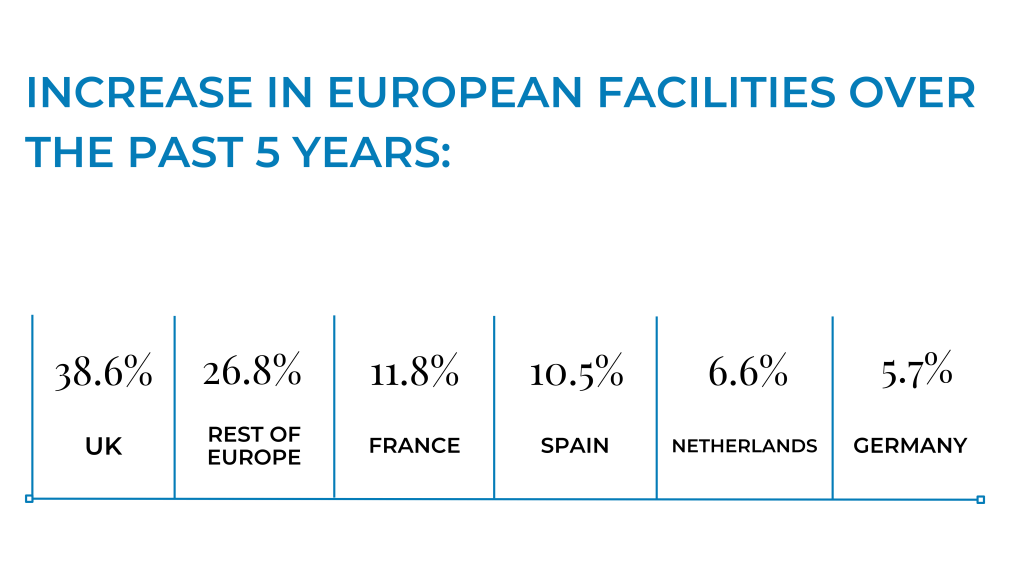

2021 total investment volumes reached €650m

70%

INCREASE IN EUROPEAN FACILITIES IN PAST 5 YEARS