Benefits

Main Benefits of Purchasing self-storage offshore

- Capital appreciation

- Rental income

- Profit from the ZAR/USD exchange rate

Property offers owners two returns.

Capital appreciation (capital growth), plus Rental income that the property generates. Place a property in an offshore location trading in a hard currency and you get an extra benefit – you profit from the strong Dollar against the weakening Rand

Capital Appreciation

Capital Appreciation

The increase in the value of a property over time.

Real estate is a time-tested avenue for wealth accumulation, with capital appreciation referring to the increase in property value over time.

While property values can fluctuate, history shows that real estate typically appreciates steadily over the long term. Factors fuelling this upward trend include robust economic and infrastructure growth that drive up demand and enhance investment prospects.

Global Property Markets

Property Market in SA

The South African real estate market has been depressed for several years due to high unemployment, strained household finances, and persistent political and economic turmoil, prompting South Africans to explore more resilient markets promising both growth and greater appreciation potential.

Property market in Eastern Europe, The Republic of Georgia

Georgia’s flourishing economy and progressive policies creates an attractive real estate market for investment. With its increasing economic stability and growth, investing in self-storage in Georgia offers the potential for capital appreciation in a market backed by the US dollar.

Investing in self-storage in the Rep. of Georgia, presents a strategic opportunity that capitalizes on its economic growth, favorable business environment and the escalating demand for storage solutions, all underpinned by a stable, USD-backed financial framework.

Ready for a Property that capitalises on a flourishing economy?

Rental income

Rental Income

Commercial real estate attracts interest for its dual promise: STEADY CASH FLOW and EFFORTLESS EARNINGS. A professionally managed property is the key to create a hassle-free income stream.

Managing rental properties typically requires active management and effort, from maintenance to tenant relations. However, our self-storage units are completely managed for you, by Self-storage Georgia (our Storage Management Agent). You receive a fully managed service, eliminating the day-to-day operational burden.

Your property is in capable hands, covering:

01

Marketing and Advertising

02

Tenant Acquisition and Relations

03

Rent

Collection

04

Maintenance Oversight

05

Financial Record Keeping

06

Handling of Legal Matters

Experience the ease of

A truly passive Income + capital growth

with buy-to-let self-storage units in Europe

overseen by our dedicated management team at Self-storage Georgia

Owning multiple rental properties is commonly considered a way to balance the risk of vacancy in any single property.

The strategy: When one property is unoccupied, the rental income from others continues, thus maintaining a steadier income overall.

Offshore Self-storage units require less input capital, providing you an opportunity to purchase multiple units. You get scalability, ease of income, risk mitigation, and zero management.

Profit from the exchange rate

Profit from the ZAR/USD exchange rate

The ZAR/USD exchange rate can be your friend.

Pair a buy-to-let property with an offshore location (a USD backed economy) and you actually benefit from the strong Dollar against the weakening Rand.

The continual depreciation of the Rand against the USD, means that returns converted back to Rand will increase over time, even if the property’s value in USD remains constant. For example, if the rand slips 8% against the dollar, your property receives an 8% boost on top of the capital appreciation/returns, when converted to the rand.

Experts predict there is little hope for the rand to strengthen.

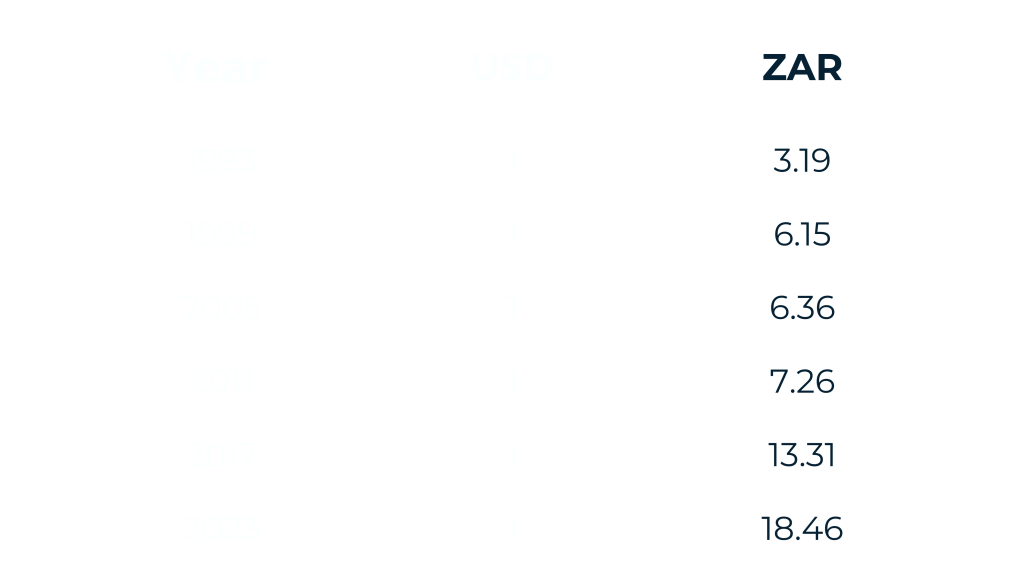

The ZAR performance against the USD has weakened over the last 25 years.

SA Reserve Bank – ZAR/USD historic rates:

Your rand is worth less every year

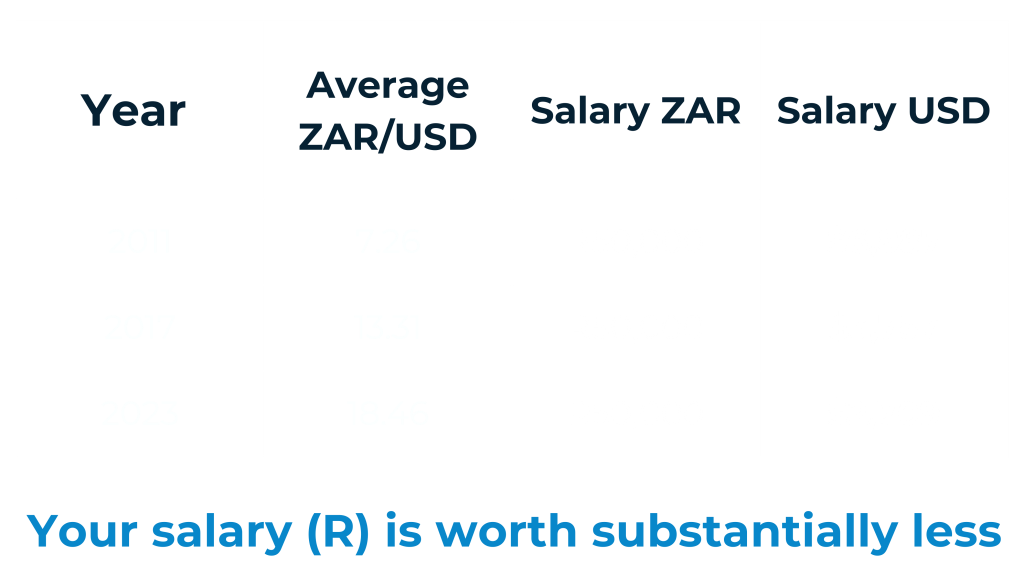

Scenario 1

Let’s say you earned a salary of R50,000 per month for the past 20 years. This is what you would have earned in dollars:

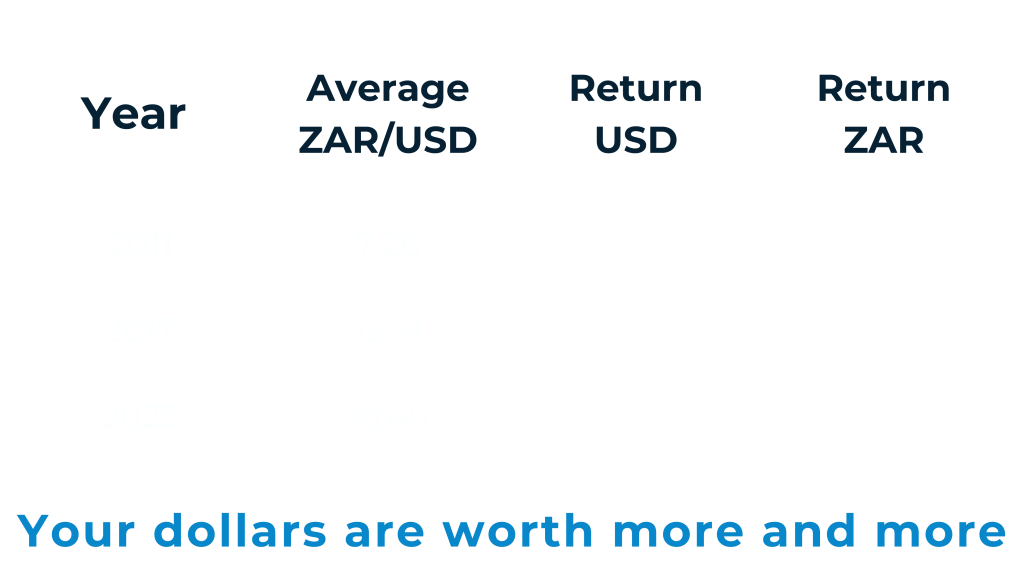

Scenario 2

Let’s say you had a $1000 salary / income / return per month for the past 20 years. This is what it would have been worth: